The Effect of the War in Ukraine on the European and US Economy:

The war in Ukraine continues to have a tremendous humanitarian impact on the Ukrainian population and has spurred a range of economic sanctions against Russia. These have intentionally affected the trade relationship between Russia and Europe leading to significant changes in the European economies but also with a direct effect on the US economy.

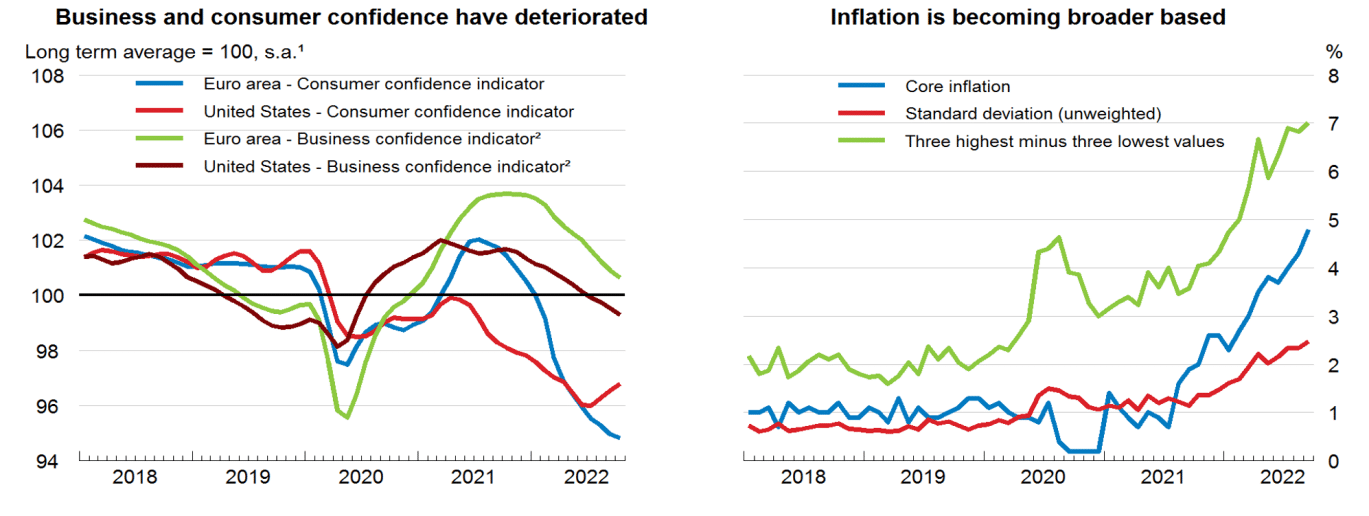

While the European Union was still feeling the effects of the economic sanctions imposed in 2014 in response to Russia’s annexation of Crimea, the new and much more severe sanctions imposed on Russia after its invasion of Ukraine have had an even more dramatic effect, including significantly slower economic growth, depressed consumer confidence, and sharply rising price levels. As with any major economic effects, these are not only being driven by the Was in Ukraine, however, it is apparent that has had a very negative impact on its own.

US:

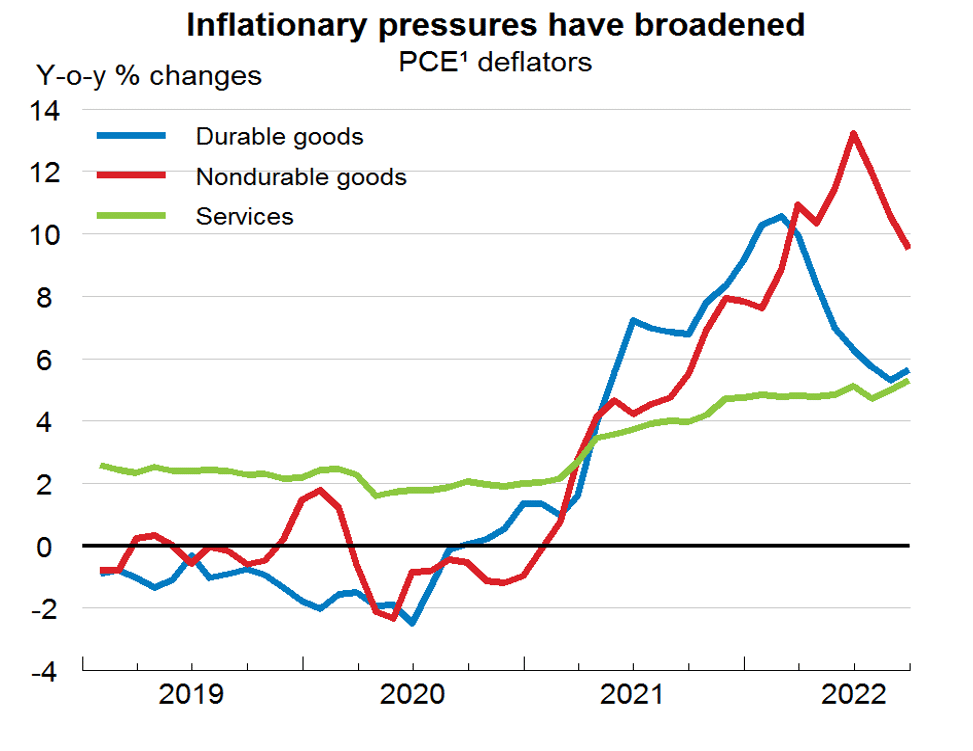

According to the OECD, Russia’s aggression against Ukraine continues to have a significant negative impact on the world economy. The OECD reports substantially slower growth rates than in prior years in a study dated November 2022, with the EU being particularly affected. The whole European economy has suffered as a result of these sanctions, but the agricultural and energy industries have been especially hard hit.

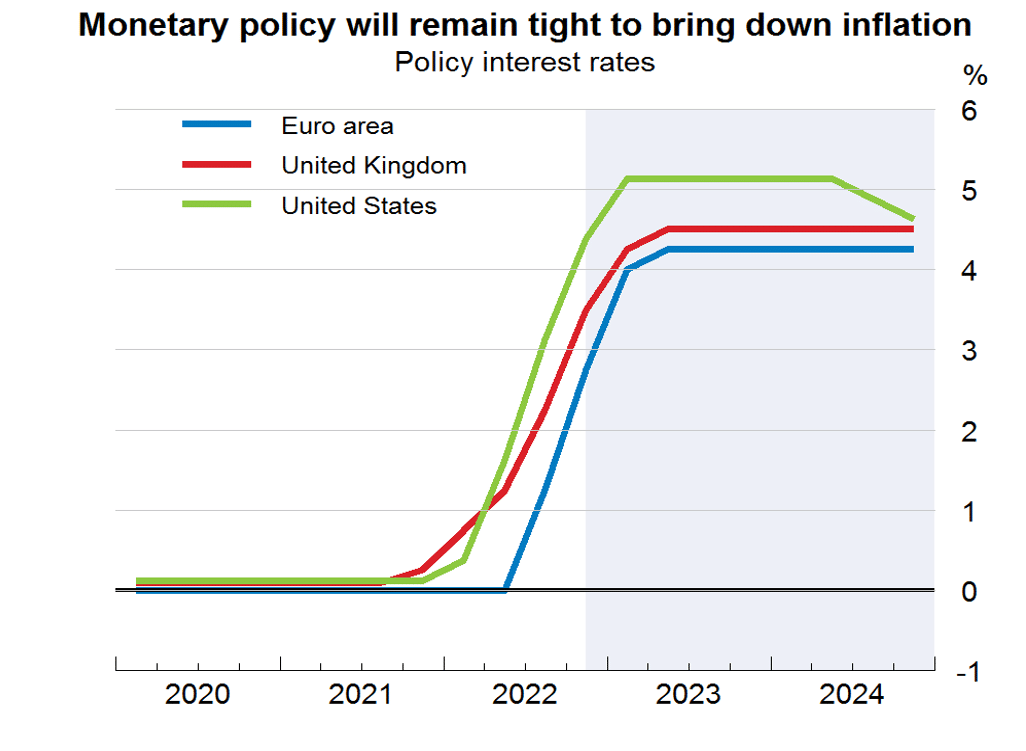

The sanctions and the underlying macroeconomic development immediately impacted the European and US economy with sharply increasing inflation which must and have been countered with government increases in central and national interest rates increases.

Also, the conflict has increased geopolitical tensions and uncertainty in general, making it more difficult for European businesses to make long-term plans due to higher uncertainty and less risk appetite – further slower economic development across Europe and the US.

Companies have by and large been forced to shift from a growth situation into a “survival” mode putting management and especially the CFO front and center to handle the impact.

The CFO plays a critical role in mitigating the rollover effect of the war in Ukraine on European but also the most exposed US companies. CFOs need to be proactive in identifying the potential risks and opportunities arising from the ongoing conflict in Ukraine. They must also be able to have their extended organizations execute accordingly – even though some remedies such as procurement and sales might not directly reside under their area of responsibility.

From a supplier and cost optimization perspective, we see a range of concrete initiatives being executed e.g.

- Diversifications of their supply chains continue as started during the Pandemic. The challenge here is the new limitations in nearshore options with Ukraine no longer being a safe option.

- Digital planning tools together with supplier inventories prove impactful in managing cash flow and stock levels.

- Rapid renegotiations are being tried once again – but this was already done by most during the pandemic.

- Contract compliance is back in fashion (as it should be!) – but are the organizations ready for the needed follow-up without drowning in spend/contract data challenges?

- Expense mng. is key but often this was already reduced during COVID, so we expect minimal additional effects here.

- Automation to reduce labor cost exposures is ripe but projects are slow to get started.

- Payment flows and terms are in focus but rarely implemented fully due to resource constraints.

From a cost perspective during COVID we saw a lot more activity in diversifications of the supply chains and near-shoring. However, the economic sanctions against Russia and the security risks in Ukraine have made it difficult for European companies to source certain goods from Russia and Ukraine. This does not remove the need for supply chain the diversification and better cost control, but it does complicate the execution options for CFOs, CPOs, and COOs alike.

Conclusion:

The prolonged war in Ukraine has had a ripple impact on the European economy with some significant spillover effects in the US. The CFOs need to be proactive in reducing the risks and seeing the possibilities it presents for the long term.

Feedback from the network is that the CFOs have read the situation and fully understand that postponing action is not an option, and no one is expecting a short-term return to “normality”.

Companies are taking steps to strengthen their cash flows and prepare for the likely drop in income associated with lower economic activity in general while focusing on building a resilient and sustainable future in the turbulent times ahead.

References:

-European Commission (2021), EU-Ukraine Association Agreement, available at:

https://ec.europa.eu/trade/policy/countries-and-regions/countries/ukraine/

-European Parliament (2021), EU economic sanctions against Russia, available at:

https://www.consilium.europa.eu/en/policies/sanctions/restrictive-measures-against-russia-over-ukraine/sanctions-against-russia-explained/

-Investopedia (2021), Diversification Definition, available at:

https://www.investopedia.com/terms/d/diversification.asp

-Harvard Business Review (2015), The CFO’s Role in Mitigating Geopolitical Risks, available at:

https://hbr.org/2022/11/how-companies-can-navigate-todays-geopolitical-risks

-Organization for Economic Cooperation and Development. (2022, February 14).

Russia’s War of Aggression Against Ukraine Continues to Create Serious Headwinds for Global Economy. Retrieved from

https://www.oecd.org/newsroom/russia-s-war-of-aggression-against-ukraine-continues-to-create-serious-headwinds-for-global-economy.htm

-Organization for Economic Cooperation and Development. (2021). OECD Economic Outlook, Volume 2021 Issue 2. OECD iLibrary, OECD Euro:

https://www.oecd-ilibrary.org/sites/f6da2159-en/1/3/2/16/index.html?itemId=/content/publication/f6da2159-en&_csp_=761d023775ff288a22ebcaaa183fbd6c&itemIGO=oecd&itemContentType=book & US: https://www.oecd-ilibrary.org/sites/f6da2159-en/1/3/2/49/index.html?itemId=/content/publication/f6da2159-en&_csp_=761d023775ff288a22ebcaaa183fbd6c&itemIGO=oecd&itemContentType=book